The Ultimate Cash Flow Oxygen Strategy is the Strength of One code of your business. The numbers in your business tell a narrative and the way to read it is with Four Stages. Here is how to simply manage your Cash, Profit and Value.

Key Takeaways

It’s high time to develop a profound understanding of your business figures by focusing on the most crucial element concealed within your financial statements – cash flow.

The global pandemic response has created an extraordinarily arduous environment for companies, leading to significant revenue decline as they were forced to close their operations for weeks or even months in certain cases.

Even if your company managed to remain profitable, you probably encountered challenges related to cash flow.

Now is the moment to confront the foremost question occupying the minds of every business leader:

How can you secure the necessary cash flow for your company’s survival and prosperity, while establishing resilient systems capable of thriving during difficult circumstances?

It’s a Do-or-Die Situation.

and NEVER before has cash been more important in a business. And as I say to every company, You can survive with decent people. You can survive with a decent strategy and decent execution, but you run out of cash and it’s game over.

Revenue is SUPERFICIAL, Profit is STABILITY and Cash is King.

Even as we move past the worst of the global pandemic, the importance of cash for business survival remains paramount. To regain a position of financial strength, you require practical guidance on how to manage and enhance your cash flow.

Here’s a comprehensive approach to confront and conquer your cash flow challenges.

What Is the Key Metric for Business Success?

In today’s landscape, the significance of your financial figures cannot be overstated. They narrate the tale of your business. As entrepreneurs, we tend to emphasize revenue in our discussions, don’t we? We delight in talking about revenue and its flashy nature, as it serves as an apparent indicator of business performance. However, revenue alone is not the most reliable gauge of a company’s success.

Regrettably, too few business owners engage in conversations about profit or its often-neglected relative, cash flow. These metrics are less conspicuous than revenue and often lie concealed within a balance sheet, making them more challenging to comprehend.

The Importance of Simplifying and Embracing Your Business Numbers

My entire life has been dedicated to simplifying numbers. I’ve shed my accounting persona and embraced the mindset of an entrepreneur. Why? Because I want to empower you to develop a fondness for your numbers.

Why is it crucial to appreciate your numbers? As entrepreneurs, when we comprehend our numbers, we can enhance them. It is only through understanding and measuring our progress that we can make meaningful improvements.

Moreover, it is vital that you equip your management team with the ability to comprehend and appreciate your numbers, as they hold the key to enhancing your business’s performance and ensuring its survival.

My objective is to demystify numbers and make them accessible. Let’s begin by focusing on this fundamental principle:

“While revenue may be captivating, it is profit that ensures stability, and cash flow reigns supreme in securing the success of your business.”

In our longing for live sporting events and the cancellation they faced due to the pandemic, let’s shift our perspective and consider cash flow as a game. As ambitious entrepreneurs, we all strive to emerge victorious in this game, don’t we? Now, the question arises: How do you achieve that victory?

By attaining the highest score.

But what does this score comprise? How can you maximize your score and achieve success in the game of cash flow?

The score to aim for is cash. Cash reigns supreme, serving as both king and queen in this context.

Elevating your cash flow boosts your score in this fiercely competitive environment. That’s the key to winning. Now, let’s delve into the players involved.

When I step into most companies, even the most talented individuals are unaware of the score. They lack comprehension of the game and are unfamiliar with the governing rules, leaving them unaware of how to emerge victorious.

This needs to change, and I’m here to provide you with the tools to bring about that change.

What Does Cash Flow Mean?

Let’s start with the basics: What exactly is cash flow? As a member of the accounting profession myself, I must admit that we have made cash flow one of the most complex concepts. Therefore, I have taken it upon myself to provide a simpler explanation.

In its simplest form, cash flow refers to the movement of money into and out of all your bank accounts within a specific time frame. This encompasses both the payments your company receives for goods and services and the payments you make to vendors, suppliers, and creditors.

Here’s an example to illustrate: If you begin the year with $10,000 in your bank account and end the year with $1,000, your cash flow is -$9,000.

Cash flow serves as a performance metric for the company’s CEO, and in the given example, it reflects a dismal performance, with a decline of 90%.

Cash flow encompasses:

- Cash balances in bank accounts

- Long-term debt, including any changes to it

- Short-term debt, including any changes to it

On a monthly basis, gather your team and quickly calculate the net cash flow by examining changes in bank account balances, along with any loans or debts and their corresponding changes.

It is crucial for your non-financial team members to understand the score of the game and how to enhance it. And remember, the score is cash.

Teach them about cash flow in a simple and non-intimidating manner, and observe how your cash flow position improves.

Understanding the Balance Sheet

In my interactions with business owners, I’ve noticed that most can interpret a Profit and Loss (P&L) statement. Almost every company I visit understands the P&L in a consistent manner. However, it’s a harsh reality in the business world that profitability does not guarantee positive cash flow. Profit and cash flow are distinct concepts.

One question that often stumps people is: Why does a gap exist between our profit and cash flow?

To truly grasp the story of your business, it is insufficient to only understand its profit. Your balance sheet holds equal importance.

A balance sheet serves as a snapshot of your company’s assets and liabilities at any given moment.

Simplified Explanation of the Balance Sheet

Let me condense the concept of a balance sheet into a single sentence:

Your available funding must match your operational activities.

YOUR BALANCE SHEET IN ONE SENTENCE

That’s as straightforward as it gets, right? However, this simple statement encapsulates a wealth of information about your business and its performance. So, let’s unpack it.

The funding you possess, which comprises both equity and debts, must align with the financial resources involved in your company’s day-to-day operations. That’s why it’s referred to as a balance sheet—both sides of the equation must be in equilibrium.

Any additions or subtractions on the funding side of the equation directly impact the operational side, and vice versa. The two sides of the balance sheet work in harmony and are intricately interconnected.

I want to emphasize: Your funding must equal your operations.

Funding consists of two essential components:

- Equity: The ownership interests in your company

- Debts: The obligations and liabilities your company owes

Operations also encompass two key components:

- Working capital, which comprises payables, receivables, and inventory.

- “Other,” which encompasses the more complex aspects that often evoke apprehension regarding the balance sheet, such as owned land and buildings.

Of these two operational components, the first one—working capital—is dynamic and can be enhanced through effective management by your management team. The second component, which I refer to as “Other,” is relatively stable and is not directly relevant to our current discussion on improving cash flow.

As a business owner, it is crucial to recognize that your management team has control over the three processes that constitute working capital: payables, receivables, and inventory.

These three factors can be modified and optimized, leading to an improvement in your working capital.

Let’s shift our focus to these three processes that your management team oversees.

3 Factors of Working Capital Under the Control of Your Management Team

Your management team holds the reins to your company’s working capital, which is determined by:

- Accounts Receivable (The speed at which we collect payments)

- Inventory (The quantity of products or work in progress we maintain)

- Accounts Payable (The speed at which we settle supplier invoices)

The way your management team manages these components directly impacts the efficiency of your working capital.

Enhancing the efficiency of your working capital translates to improved cash flow and a higher score in the game.

Strategies to Enhance Working Capital Efficiency

There are four effective approaches to improve the efficiency of your working capital:

- Expedite invoice generation and delivery.

- Accelerate the collection of payments.

- Enhance inventory management practices.

- Negotiate extended payment terms with suppliers.

When you communicate and explain these methods to your management team, they begin to grasp their crucial role in managing your company’s cash flow.

Consistently emphasizing the significance of numbers and illustrating how their actions directly impact these numbers, you empower your team with the knowledge to significantly influence cash flow and ultimately secure victory in the game.

The reason why many companies are currently facing unprecedented challenges is that they never crowned cash flow as king. Profitability management always took precedence.

However, it is cash flow—not profitability—that demands your utmost attention and focus.

ESTABLISH YOUR STRATEGY HUB

We’ve established that our common objective is to emerge victorious in the game, with the game being centered around generating more cash.

I highly recommend that all my clients establish a strategy hub, which I refer to as the “War Room.” This dedicated space should be attended by your senior management team, including representatives from operations, sales, marketing, and finance.

Within this War Room, prominently display your financial metrics for everyone to observe, discuss, and track. Transparency is paramount. It is crucial for all members of your management team to comprehend how their decisions can impact your company’s profitability and working capital. Holding your management team accountable for their actions in improving working capital and, consequently, cash flow is essential.

By creating this centralized hub and fostering open discussions, you equip your team with the necessary knowledge and motivation to drive positive change and steer your company towards financial success.

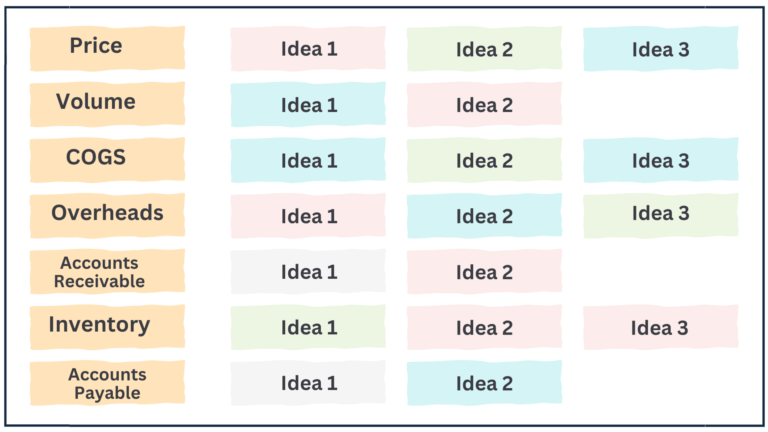

The 7 Leading Drivers are Profits, Cash Flow, and Business Value

Your management team possesses control over seven essential levers that hold the strength to influence your profits, cash flow, and overall business value.

The first four drivers focus on managing profit levels, while the remaining three concentrate on optimizing working capital efficiency:

- Price: Evaluate pricing strategies and explore opportunities for adjustments.

- Volume: Identify areas where positive changes in sales volume can be made.

- Cost of Goods: Examine and optimize the costs associated with producing goods.

- Overhead: Analyze and manage overhead expenses to enhance profitability.

- Accounts Receivable Days: Implement strategies to shorten the collection time from customers.

- Inventory/Work in Process: Optimize inventory levels to improve cash flow without compromising business operations.

- Accounts Payable Days: Explore opportunities to negotiate extended payment terms with suppliers.

During monthly meetings, engage in comprehensive discussions about each of the 7 Drivers, delving into the associated numbers and seeking actionable ideas from your team to enhance them.

In my own monthly management meetings, we conduct an in-depth exploration of every profit component. We evaluate our pricing strategy, assess the feasibility of price increases, examine sales volumes for potential improvements, and critically analyze margins. We scrutinize each line item to identify opportunities for better management and enhanced profitability.

Following that, we focus on devising strategies to optimize working capital. We explore ways to improve the collection process and shorten payment cycles from customers. We consider inventory levels and seek ways to reduce excess without compromising our business model. Additionally, we assess whether negotiations with suppliers for extended payment terms could be advantageous, such as increasing payment periods from 30 to 45, 60, or even 90 days.

It is crucial for your management team to understand how their daily actions and decisions significantly impact your company’s overall cash flow. By fostering this understanding, you empower them to contribute actively and strategically to the financial success of the business.

Guide Your Management Team to Strategic Gameplay

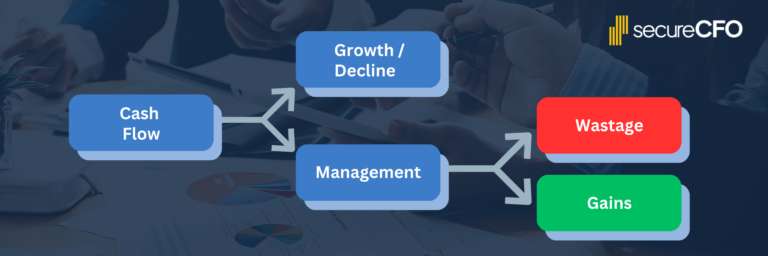

Your management team is responsible for making critical decisions that shape the course of your company on a daily basis. By teaching them to strategically play the game, they can drive gains and positive outcomes. As they gain a deep understanding of the 7 Drivers they control, which can impact both profit and working capital, they will consider the effects of their decisions on cash flow.

Empower your management team with the knowledge that they have a direct impact on profit and working capital. Reinforce the following principles consistently:

- Increasing prices contributes positively to cash flow.

- Decreasing margins has a negative impact on cash flow.

- Slow collection of payments adversely affects cash flow.

- Delaying payments has a positive influence on cash flow.

- Escalating overhead expenses detrimentally affects cash flow.

Teach your team to excel in their roles by providing them with the guidelines for winning the cash flow game. Your management team is inherently competitive and driven to contribute to the success of the business.

By reminding them that the company’s cash flow is the outcome of growth and effective management, they will begin to generate gains and strive for continuous improvement.

CASH FLOW QUALITY

What is the Strength of One

The Strength of One lies in the potential of small, incremental changes to each of the 7 Drivers to yield significant transformations for your business. It highlights the profound impact even a one percent alteration in any of these drivers can have on your cash flow position.

Every company possesses gaps that can be narrowed. During each meeting, prompt your team with the question: What gaps do we need to address in our company?

Consider these potential gaps that may require attention:

- A 2.5% gap in margins and profitability

- A 16-day gap in receivables

- A 28-day gap in inventory

A mere one percent improvement in any of these metrics alone can generate a considerable increase in your cash reserves.

Each month, challenge your team to generate actionable ideas on how to enhance each of the 7 Drivers by at least one percent—or more. Encourage them to jot down their suggestions on sticky notes and display them for everyone to see.

Next, evaluate which two or three of these ideas you will implement that month to bolster your working capital efficiency and strengthen your cash position.

At SecureCFO, we use software that showcases how the Strength of One can impact your business—how small, incremental changes can yield powerful results.

Harness the Strength of One for Your Business

The Strength of One serves as the gateway to solving your cash flow challenges.

It offers an interactive platform that enables your management team to witness real-time insights, demonstrating how even a one percent increase in prices or a five percent reduction in overhead can significantly enhance cash flow and operating profit. Utilize the team at SecureCFO to inspire your team to brainstorm innovative ways to implement small, incremental changes that accumulate into a substantial impact on your bottom line.

You can access your own Strength of One cash flow analysis worksheet and work through it here.

By consistently leading honest, transparent, and strategic discussions with your management team, the Strength of One becomes ingrained in your company’s DNA. Your team begins to comprehend how every decision they make and action they take influences the company’s cash flow position.

Each month, introduce one or two meaningful Strength of One changes.

For instance, you might opt to increase prices by two percent and improve collections by seven days this month.

WORKSHOPPING THE STRENGTH OF ONE

Over time, these gradual adjustments exert a remarkable influence on building cash flow and transforming your company. This is how you shift the score. Determine which changes to implement, demonstrate to your team how their actions and decisions translate into improved cash flow, and watch the score gradually improve.

Remember, cash flow is a direct outcome of growth and effective management. It has never been more crucial for your management team to understand the score, with cash being the ultimate measure.

By assisting your management team in comprehending and embracing your financial numbers through simplified and accessible terms, your top-performers will seize the opportunity and continuously score with ongoing cash flow improvements—ultimately leading to victory in the game!

At SecureCFO, we manage the accounting needs of businesses, regardless of size, with a keen eye for detail and customization. We go beyond the general ledger by offering expert advice on accounting software and personalized services. Understanding general ledger accounting and its reliance on double-entry bookkeeping equips business owners with the knowledge to better manage their financial health and make informed decisions.

As a certified CFO, I bring a robust blend of expertise and accreditation to the table, ensuring that my strategic financial management and controller services not only aligns with industry best practices but also drives substantial value and innovation in the services sector. My certification is a testament to my commitment to excellence and my capability to navigate complex financial landscapes effectively, making me a trusted advisor in your journey towards greater profitability and business success.

Start mastering your financials today! Dive deeper into how outsourced accounting services can revolutionize your business strategy and lead to sustained profitability. Don’t wait, unlock your business’s full potential now!