Is enhancing Profit, Cash Flow, and Business Valuation the primary objective of your enterprise? Learn How with The Strength of One.

In many management meetings, financial discussions are fragmented, with most team members unclear about the details. Specifically, few around the table grasp cash flow and how their actions affect these figures.

Just like following a chess game requires a scoreboard, your business operates similarly. It’s vital to educate your team on understanding the company’s ‘scoreboard’ and the levers they can manipulate to boost Profit, Cash, and Valuation.

As leaders, constantly revisiting Stage 1 without grasping its implications often leads to confusion about our business outcomes.

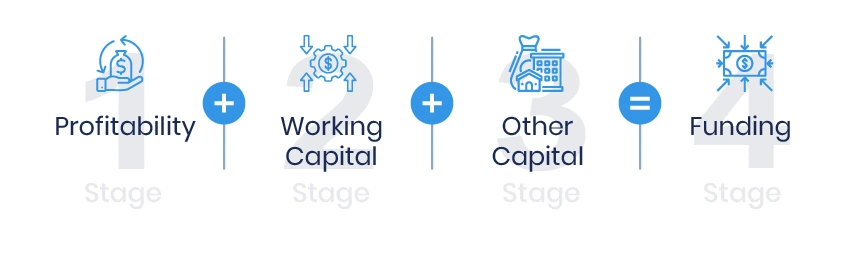

The Strength of One Narrative of Numbers is told over 4 Stages:

Stage 1- Profit

Stage 2- Working Capital (Accounts Receivable, Inventory/WIP, Accounts payable)

Stage 3- Other Capital (This is the rest of the Balance Sheet and the main item is normally Fixed Assets)

Stage 4- Cash Flow (The result of the business is the Funding – A quick way to calculate Stage 4 is the movement your Cash at bank and borrowings)

Your management team should possess a solid comprehension of Stage 1- Profit and Stage 2- Working Capital.

Your management team can influence seven crucial levers to enhance Profit, Cash, and Value.

Stage 1 Levers (Measured as a %)

- Price

- Volume

- Cost of Goods Sold or Direct Costs

- Overheads

Stage 2 Levers (Measured in Days)

- Accounts Receivable

- Inventory Days

- Accounts payable

What number of 1% or 1 day adjustments should your company implement to reach your targeted outcomes?

The Strength of One represents the unique code for each company – every business has its distinct formula.

Do you have enough cash to pay your vendors, staff and tax this month?

It’s essential to include a quarterly ‘Strength of One’ discussion in your board or management meetings.

Achieve Your Business Goals with Our Help

Small business owners have a lot on their plate. From managing day-to-day operations to finding new customers, it can be overwhelming. But one of the biggest challenges facing most small business owners is not having clear goals.

Without clear and well thought out goals for the things that matter most, like KPIs that drive revenue, profit, and cashflow, how can a business owner know if they’re making progress daily, weekly, or monthly?

It’s like getting in the car and driving without a clear destination. You’ll waste a lot of gas and a lot of time. However, this is typical of most business owners – they’re ‘driving’ without knowing exactly where they want to end up.

That’s where we come in. At SecureCFO , we can help you set clear and achievable goals for your business. We’ll work with you to identify the KPIs that matter most and create a roadmap to help you get there.

With our help, you’ll be able to track your progress and make informed decisions to ensure that your business is moving in the right direction. No more aimless driving – you’ll know exactly where you’re headed and how to get there.

Don’t let the lack of clear goals hold your business back. Contact us today to schedule a consultation and take the first step towards achieving your business goals.

Achieve Your Business Goals with Our Help. Contact SecureCFO Today!