How to Reconcile Accounts is essential for running a small business. Balancing budgets handling payroll, and ensuring all numbers add up at the end of the day is critical. This essential task, known as reconciliation accounting, is pivotal in keeping your business accounting in check. Thankfully, you don’t have to navigate these waters alone—outsourced accounting services like SecureCFO are available to assist you.

Reconciliation Definition: What Is Reconciliation Accounting?

Reconciliation accounting involves determining the cash available in your business’s general checking account. To execute this process effectively, you need to track every transaction closely and compile them into a reconciliation report. This report may include invoices, contracts, and other pertinent documents. Regular and meticulous financial reconciliation is vital for the growth and health of your business.

Step-by-Step Guide: How to Reconcile Accounts

Follow these steps to ensure seamless account reconciliation:

- Grab Your Statement: Start by getting the latest statement for the account you’re reconciling—be it bank or credit card.

- Check Previous Balance: Ensure last month’s ending balance in your software.

- Enter Ending Balance: Punch in the ending balance from your statement into that matching field in your software or ledger.

- Mark Transactions: Label deposits, checks—all transactions—as entered if they show up on the statement.

- Add New Entries: Introduce any fresh transactions from the statement missing in your records.

- Review Unmatched Transactions: Look over entries not yet showing up—like undeposited payments and uncleared checks—and confirm they belong there; adjust if necessary.

- Zero Difference Goal? Make sure there’s no difference ($0) between adjusted totals and bank balance.; review again if they’re off!

- Print & File: Once everything aligns perfectly (phew!), print out that report and attach it to the corresponding statement for filing purposes.

By ticking off these tasks methodically—you ensure every transaction belongs where it does…not somewhere else…AND! You’re showing you’re running an honest operation which helps shield you from any legal slip-ups!

How to Reconcile Accounts-Example Time!

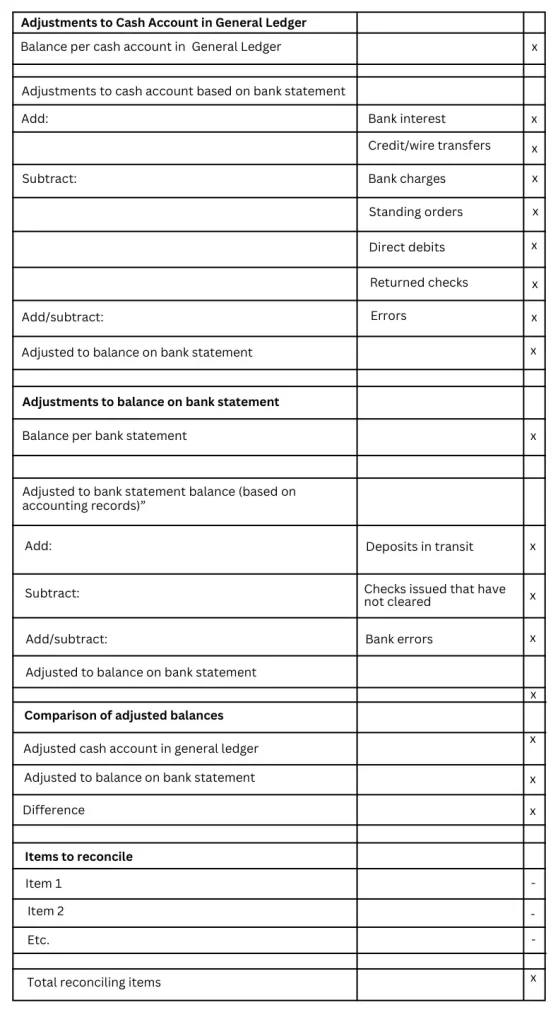

Picture this sheet used for compiling reconciliations looking somewhat like this one (just imagine ‘x’ marks representing correct values):

Different Types of Reconciliation

There are five main types of reconciliation accounting that are used in day-to-day business:

- Bank Reconciliation

- Customer Reconciliation

- Vendor Reconciliation

- Inter-company Reconciliation

- Business-Specific Reconciliation

These processes can be considered the backbone of effective bookkeeping.

Why Is Bank Reconciliation Important?

Conducting precise bank reconciliations helps identify errors such as missed payments or calculation mistakes. It also aids in tracking hidden costs like fees and penalties, and detecting potential fraud. Regular reconciliation ensures that accounts payable and receivable statuses are accurately monitored, keeping your business finances balanced and transparent.

Frequency: How Often Should You Reconcile Accounts?

You should perform reconciliations every time a statement arrives. However, depending on the volume of transactions, this can be done weekly or monthly. Understanding “How to Reconcile Accounts” means you don’t have to do it alone—outsourcing with SecureCFO allows you to save valuable resources while ensuring your financial records are always accurate.

SecureCFO: Your Partner in Efficient Accounting

Setting high goals for your business? Let SecureCFO manage the detailed tasks—online accounting and bookkeeping services tailored to drive your business forward. With customized solutions covering credits and debits accurately, SecureCFO stands ready to assist you in maximizing your potential profits.

Get started today by downloading our pricing sheets or giving us a call for detailed inquiries. SecureCFO offers uniquely designed proposals that fit your business model comprehensively and efficiently.

Incorporating proper reconciliation practices not only ensures smooth financial operations but also sets the stage for sustained business growth. Trust in SecureCFO to handle the intricacies of accounting while you focus on strategic priorities.

As a certified CFO, I bring a robust blend of expertise and accreditation to the table, ensuring that my strategic financial management and controller services not only aligns with industry best practices but also drives substantial value and innovation in the services sector. My certification is a testament to my commitment to excellence and my capability to navigate complex financial landscapes effectively, making me a trusted advisor in your journey towards greater profitability and business success.

Start mastering your financials today! Dive deeper into how outsourced accounting services can revolutionize your business strategy and lead to sustained profitability. Don’t wait, unlock your business’s full potential now!