Contribution Margin isn’t just another figure on your financial statement—it’s a vital tool in management accounting. To move beyond merely breaking even and start generating profits, grasping your contribution margin is essential. Analyzing this key metric is one of the quickest ways to propel your business towards increased profitability.

How Contribution Margin Helps You Break Even: Fundamental Concepts

Your contribution margin represents the revenue remaining after all variable costs are covered. It is calculated by subtracting your total variable costs from your revenue.

Contribution Margin = Revenue – Variable Costs

Contribution margin reflects the amount each client adds towards covering overhead and generating profit, which is why it’s termed “contribution” margin. Essentially, it’s your gross profit margin reduced by any variable overhead expenses, such as sales commissions.

A business reaches its break-even point when the dollars from the contribution margin match the fixed costs. Profit generation begins once the contribution margin exceeds these fixed costs.

To compute your contribution margin, categorize your expenses into two groups: variable costs and fixed costs.

Why is Understanding Your Contribution Margin Important?

Contribution margin analyzes each incoming dollar, revealing how much revenue is allocated towards covering overhead and generating profit. Without understanding your contribution margin, it’s impossible to accurately determine your break-even point.

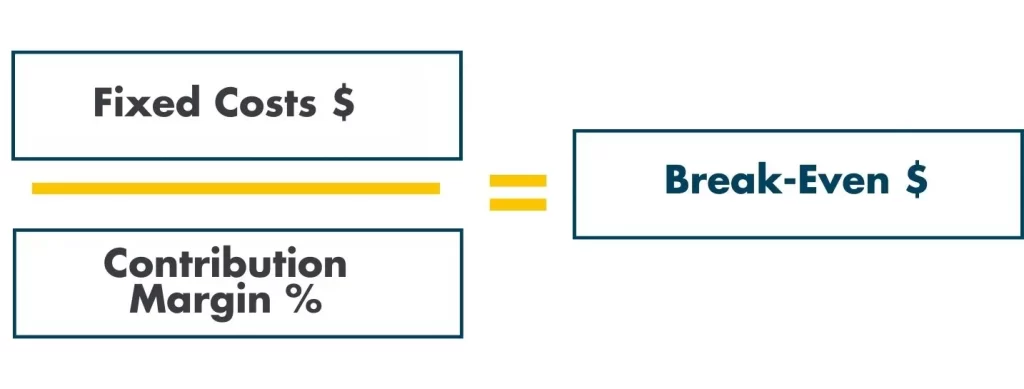

Knowing your profit margins on specific tasks is crucial for this calculation. You can determine your break-even point using this straightforward formula.

At the break-even point, your total contribution margin just manages to cover your fixed costs, leaving no surplus for profit or free cash flow. Essentially, the break-even point is reached when your contribution margin dollars match your fixed costs exactly.

Comparing Contribution Margin and Gross Profit Percentage

Despite common misconceptions, the most crucial figure on a financial statement isn’t net income—it’s the gross profit percentage.

Gross profit is the foundation of net income. By boosting your gross profit, you effectively increase the amount of money that flows directly into your bottom line and ultimately into your bank account.

This is why seasoned investors often inquire, “What’s your selling price and what are the total costs?” They’re determining the gross profit percentage, not just the gross profit in dollars. This calculation reveals the potential profitability of a business. Maintaining robust profit margins is key to enhancing your business’s financial health.

The key distinction between gross profit margin (also referred to as gross profit or gross margin) and contribution margin lies in the “variable” costs. Variable costs are expenses that arise whenever you acquire a new client.

Consider both contribution margin and gross profit margin in percentage terms.

Why focus on gross profit percentage rather than just the dollar amount? Because the percentage of gross profit reveals the efficiency of your business operations. It indicates whether you are pricing your services or products correctly—a critical decision for any business owner.

While contribution margin differs from gross profit margin, both metrics serve as essential tools for management. They can be analyzed in terms of both dollars and percentages, offering distinct insights. To enhance profitability, it’s crucial to also analyze your contribution margin alongside gross profit.

Gross Profit Margin = Revenue – COGS

The calculation of gross profit already accounts for the direct variable expenses that are considered “above the line.” However, it’s necessary to also factor in the variable costs that fall “below the line.”

The distinction between gross profit margin and contribution margin lies in the indirect or overhead expenses that vary. Many business owners focus solely on the variable costs that are above the line and conclude at gross profit. Yet, to accurately determine your break-even point, you must also deduct the variable costs that are below the line.

What Are Examples of Below the Line Costs

“Below the line costs” refers to your overhead expenses, which are the costs not directly covered by your customers. These are known as indirect costs and typically include selling expenses, marketing, accounting, IT, HR, facilities, legal, and more. When these expenses increase due to the addition of a new customer, they are variable, yet still categorized as indirect because they are not directly borne by the customer.

A common example is sales commissions. Although customers do not directly pay for the efforts of your sales team, these professionals generate business, which indirectly supports service delivery. Thus, sales expenses fall below the line.

Consider a scenario where a client needed to provide housing for workers on an oilfield project. Providing housing made recruitment easier. Although the rent expense was directly tied to the project, making it variable, it was an indirect cost from the client’s perspective. We included such costs in our contribution margin calculations to accurately reflect all expenses tied to that project.

When calculating your break-even point, it’s essential to subtract any below-the-line costs like commissions from your gross profit. This calculation is crucial because your break-even goal is to cover all fixed costs. Any commissions paid reduce the available profit meant to cover these fixed costs.

What Drivers Can Boost Your Profitability?

How can you enhance your profits or achieve break-even? There are two main drivers to consider:

- Boost your contribution margin

- Reduce your fixed costs

To elevate your contribution margin, you have two options: increase your sales or reduce your direct costs, which include direct labor and materials.

Enhancing Your Contribution Margin: Addressing Time Leakage

Identifying time leakage is one of the simplest methods to boost your revenue. Time leakage occurs when you are paying for time that you are not billing to the client, either because you are over-delivering or under-utilizing your staff.

The key to capitalizing on time leakage is to meticulously track time and compare the actual costs of each job to its budgeted costs—the costs you anticipated when drafting the proposal.

From our experience, when you clearly demonstrate to clients the additional value they receive but aren’t charged for, most are willing to pay for these services, provided:

They are satisfied with your service.

You can clearly demonstrate the added value that warrants the extra billing.

If you find yourself giving away valuable time and it’s impacting your profitability, the quickest remedy is to engage with your current clients about the uncharged value they are receiving. Value pricing experts suggest three approaches to adjust billing for this value:

Increase fees to accurately reflect the real value clients are receiving.

Reduce the scope of services to keep client costs within budget.

Consider transitioning them to another service provider if necessary.

Billing accurately for time leakage is an effective way to balance your accounts and enhance your profitability.

Boosting Your Contribution Margin: Effective Job Costing

Another method to enhance your contribution margin is by accurately pricing new jobs. This involves understanding the full costs (fully loaded) of delivering your services, allowing you to make data-driven decisions on pricing to achieve the desired contribution margin that covers overhead and generates profit.

Gaining a detailed understanding of your above-the-line costs is crucial for accurately pricing your goods or services. It’s important to differentiate these from your below-the-line costs. Here are straightforward steps to separate above-the-line and below-the-line costs:

- Analyze the performance of the least profitable departments or teams down to specific customers and job profitability to uncover insights for improvement.

- Determine which employees and resources are categorized as above-the-line versus below-the-line, and assign them to specific departments or teams.

- Allocate labor costs appropriately during payroll processing.

- Reorganize your chart of accounts to distinguish between above-the-line and below-the-line costs.

- Regularly review the Profit and Loss statements for each department or team to identify areas with potential for growth.

Core conclusion

To make informed, data-driven decisions, it’s crucial to understand your contribution margin percentage. This knowledge helps determine what revenues to target or expenses to reduce to achieve break-even.

Accelerating your business profits primarily involves enhancing your contribution margin. You can achieve this by either increasing your revenue or reducing your direct costs. One of the simplest methods to boost revenue is to identify and address time leakage or refine your pricing strategy.

As a certified CFO, I bring a robust blend of expertise and accreditation to the table, ensuring that my strategic financial management not only aligns with industry best practices but also drives substantial value and innovation in the services sector. My certification is a testament to my commitment to excellence and my capability to navigate complex financial landscapes effectively, making me a trusted advisor in your journey towards greater profitability and business success.

Start mastering your financials today! Dive deeper into how contribution margin can revolutionize your business strategy and lead to sustained profitability. Don’t wait, unlock your business’s full potential now!