Explore vital financial KPIs for business success. Learn 4 steps to improve your business’s cash for growth and stability in this insightful guide.

Key Takeaways

According to the U.S. Small Business Administration, only about 50% of American businesses last beyond five years, and this figure reduces to roughly 33% after 10 years.

The key to ensuring your business is among the successful ones in the long term lies significantly in how you manage financing. Effective financing is essential not just for daily operations, but also for strategic planning and informed decision-making.

Understanding the narrative behind your company’s finances is crucial. The financial health of your business can be gauged by identifying and monitoring the right financial key performance indicators (KPIs), and recognizing which KPIs demand the most attention is vital. For entrepreneurs, CEOs, and high-level executives, the significance of financial KPIs is clear.

So, what are the most critical KPIs that you need to focus on? Let’s explore further.

Financial KPIs: Key to Scaling Your Business Successfully

KPIs serve as measurable indicators that guide you in achieving your company’s vision.

While cash flow stands as the foremost financial KPI, there are several others essential for monitoring. We’ll begin by examining 8 key KPIs crucial for assessing your company’s financial wellbeing and shaping its future strategies. Following that, we’ll delve into how these KPIs can be leveraged to enhance cash flow, boost profits, and optimize time management.

Assets

Assets are valuable resources owned or managed by your company to yield future benefits. These are listed on the balance sheet and include items that can potentially generate cash, decrease costs, or enhance sales.

EBIT

EBIT, which stands for ‘earnings before interest and taxes,’ also known as operating profit, measures your business’s profitability. It’s calculated by subtracting expenses (excluding tax and interest) from revenue.

Liabilities

Total Liabilities Overview: This term encompasses the debts and obligations your organization is responsible for to external parties. Displayed on the balance sheet, liabilities are categorized as short-term, long-term, and other types.

Net Cash Flow

Cash Flow Defined: Cash flow represents the total movement of funds across all your business’ bank accounts over a specific period, encompassing all inflows and outflows. To determine your net cash flow, subtract your profit, working capital and other capital.

Profit

Understanding Profit: Profit arises when your company’s revenue surpasses its expenses, costs, and taxes. Operating profit refers to the profit calculated before taxes and dividends are taken into account, while net profit is the remaining amount after deducting taxes and dividends.

Profit Margin

Profit Margin Explained: Profit margin, presented as a percentage, indicates the amount of profit your company earns for every dollar of goods or services sold. This key performance indicator is calculated by dividing your business’s income from selling a product or service by its total revenues.

Revenue

Revenue, often referred to as sales or top line, represents the income earned from selling your products and services. It is calculated by multiplying the average sales price by the total number of units sold.

Working Capital

Understanding Working Capital: Working capital encompasses elements like payables, receivables, and inventory. It’s the capital left over when you deduct your accounts payable from the sum of your inventory and accounts receivable, which is the amount owed to you by customers.

Essential Financial KPI: Understanding Your Cash Flow

Indeed, revenue and profit are key financial KPIs, but for business scaling, they’re not as crucial as their less prominent counterpart, cash flow.

My preferred adage goes like this: Revenue is superficial, profit is stability, but cash is king or queen.

Scaling your business involves adopting new systems and processes, which can lead to increased costs that might threaten your company’s stability. Healthy profits and revenue might mask these rising expenses, as they don’t always accurately reflect your business’s financial reality.

Cash flow, the movement of money through your business’s bank accounts, includes both incoming payments for products and services and outgoing payments to vendors, suppliers, and creditors.

For instance, if your company starts the year with $10,000 in the bank but ends with only $1,000, your cash flow for the year is -$9,000.

To support your company’s growth, having accessible cash is crucial. Equally important is understanding how even minor changes, as small as 1%, can lead to significant financial improvements. This requires a deep understanding of your company’s Cash Flow Narrative and its dynamics.

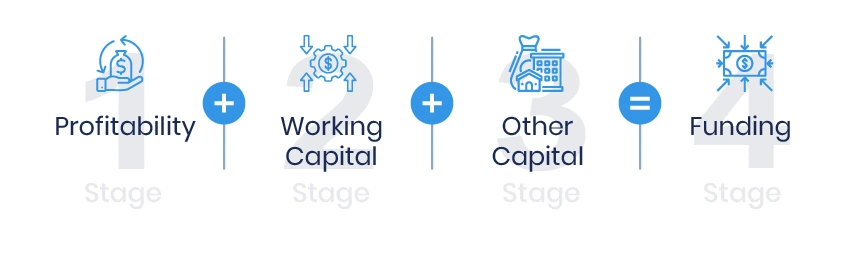

4 Stages Tell Your Company’s Cash Flow Narrative

I often compare running a business to unraveling a homicide mystery.

Consider the first stage of a mystery novel. It’s merely the beginning of the journey towards discovering the perpetrator. Similarly, your organization’s financial narrative unfolds in a comparable manner. To fully grasp it, you need to comprehend the entire narrative, which for your business, encompasses Four Stages, each intertwined with a range of crucial KPIs.

The outcomes of these KPIs in the initial three stages build the framework for your fourth stage.

Stage 1- Profit

This chapter includes the KPIs of operating profit and net profit.

Stage 2- Working Capital

The subsequent stage reveals the remaining capital after deducting your accounts payable from the sum of your inventory and accounts receivable.

Stage 3- Other Capital

This stage encompasses KPIs pertaining to extra assets like fixed assets and investments, as well as accruals and prepayments.

Stage 4 – Net Cash Flow

This concluding stage is the result of adding or subtracting the values from your first three stages. It’s where you determine if you have a positive cash flow or if additional funding is required to finance your growth.

Key KPIs Uncovered in Balance Sheets

Your Cash Flow Narrative is not just limited to the KPIs on your Profit and Loss (P&L) statement. While profit is a key indicator, it’s possible to be profitable and still lack positive cash flow.

Examine your balance sheet for an instant view of your company’s assets and liabilities at any given moment. In simplest terms, what you’ll find is this: The funding of your company must be in alignment with operations.

YOUR BALANCE SHEET IN ONE SENTENCE

The funds available to your business consist of your equity—the difference between your assets’ value and liabilities—and the debts you owe. On the operational side, numbers include working capital components like payables, receivables, and inventory, as well as fixed assets like land and buildings.

Any addition or subtraction of money on the funding side reflects in the operational figures, and vice versa. This maintains the balance.

When examining the KPIs on your balance sheet, remember that working capital —payables, receivables, and inventory—are dynamic and constantly changing. This implies that your management team has the opportunity to implement straightforward strategies that can significantly alter your Cash Flow Narrative.

How to Improve Your Cash Flow With The Strength of 1 % or 1 Day

Recognizing the significance of your KPIs, especially cash flow, is not just about assessing your company’s financial health; it also acts as a measure of your management’s effectiveness. Regular and meticulous analysis of cash flow can guide you in identifying which management decisions positively influence it.

Each month, convene your team for a rapid assessment of your net cash flow. Examine fluctuations in bank account balances, account for any loans or debts and the changes in amounts owed. Explore strategies for enhancing your working capital KPIs through management initiatives.

Even a small 1% or 1 day variation in rates can significantly boost your cash flow. Consider implementing these 1% modifications in any of these 7 key areas:

- Pricing: Boost the prices of your products or services.

- Sales Volume: Increase the quantity sold of your product or service.

- Cost of Goods Sold (COGS)/Direct Costs: Decrease the costs of raw materials and labor by implementing lean initiatives.

- Operating Expenses: Reduce operational costs and shorten sales cycles.

- Accounts Receivable: Minimize the time it takes for customers to complete payments.

- Inventory/Work in Progress: Reduce the inventory levels your business maintains.

- Accounts Payable: Aim to prolong the payment periods to your creditors.

Should you require assistance in identifying which of these areas will most significantly enhance your organization’s cash flow, feel free to download my Strength of One Tool. By inputting your EBIT and net cash flow figures, you can gain clearer insights.

Double Cash, Triple Profit, and Time Savings

Now that you’re acquainted with essential financial KPIs, the importance of cash flow, and how your balance sheet can guide management decisions, are you’re ready to utilize these KPIs to assess and improve your company’s potential for success in 2023 and the years that follow?

Are you ready to explore how making 1% or 1 Day changes can help your company?

- Increase its cash flow

- Improve its cash conversion cycle

- Learn when and where to spend

- Enhance its value

Fix Your Cash Flow with the Strength of One Tool

Achieve Your Business Goals with Our Help

Small business owners have a lot on their plate. From managing day-to-day operations to finding new customers, it can be overwhelming. But one of the biggest challenges facing most small business owners is not having clear goals.

Without clear and well thought out goals for the things that matter most, like KPIs that drive revenue, profit, and cashflow, how can a business owner know if they’re making progress daily, weekly, or monthly?

It’s like getting in the car and driving without a clear destination. You’ll waste a lot of gas and a lot of time. However, this is typical of most business owners – they’re ‘driving’ without knowing exactly where they want to end up.

That’s where we come in. At SecureCFO , we can help you set clear and achievable goals for your business. We’ll work with you to identify the KPIs that matter most and create a roadmap to help you get there.

With our help, you’ll be able to track your progress and make informed decisions to ensure that your business is moving in the right direction. No more aimless driving – you’ll know exactly where you’re headed and how to get there.

As a certified CFO, I bring a robust blend of expertise and accreditation to the table, ensuring that my strategic financial management not only aligns with industry best practices but also drives substantial value and innovation in the services sector. My certification is a testament to my commitment to excellence and my capability to navigate complex financial landscapes effectively, making me a trusted advisor in your journey towards greater profitability and business success.

Don’t let the lack of clear goals hold your business back. Contact us today to schedule a consultation and take the first step towards achieving your business goals.

Achieve Your Business Goals with Our Help. Contact SecureCFO Today!