To drive better cash flow in your business, understanding and leveraging seven key strategies is crucial. In this guide, we’ll explore how these strategies can significantly enhance your financial health and foster business growth.

Being an entrepreneur, one of your main focuses – and challenges – is to enhance your business’s value.

Grasping your company’s financials is crucial for this task.

However, the complexity of financial statements have often made it difficult to understand which numbers actually matter in your business.

Hence, my goal is to present a more uncomplicated method for understanding them.

I’ll introduce seven fundamental concepts vital for comprehending the influence of your financials on your overall success. These concepts aim to help you and your company embrace the figures, enabling informed choices to boost profit, cash flow, and overall valuation. Let’s dive in.

Drive Better Cash Flow: The Top Indicator of Business Health

By trade, I’m an Accountant.

A common trend I’ve noticed among entrepreneurs is their focus on profit and revenue, often overlooking the importance of cash.

When dealing with banks, their primary concern isn’t your revenue or profit; it’s your ability to repay debts, which boils down to cash flow. Additionally, cash is essential for funding your business’s growth.

What you, as a business leader, might not recognize is that profit and revenue are merely parts of your financial narrative. These elements significantly influence your cash flow.

That’s why I consistently emphasize:

Cash flow is the real outcome of your business’s success.

Handling Cash Flow in Your Business is Like Playing a Strategic Game

Your business can be compared to a sports game.

In this game, the objective for every company is to generate more cash.

The performance of your company in this scenario hinges on the caliber of your team. People are crucial; achieving top-tier cash flow is unattainable without a high-performing team.

Simplicity is the essence of this game.

Your task is to educate your team on the business game, which revolves around the question, “How can we enhance our profit, cash flow, and value?”

Drive better cash flow and The Cash Flow Oxygen Narrative framework and the Strength of One concept aim to foster a love for numbers among your team, transforming them into A Players. These A Players are the ones eager to win for your business and know how to make improvements.

Master the art of managing your business’s cash flow effortlessly and then impart this knowledge to your team.

This is the key to making every member of your company responsible for its growth and valuation.

Make Sure to Read Your Balance Sheet Regularly

Almost every business concentrates on the Income statement, likely due to its apparent ease of interpretation.

However, to truly narrate your company’s financial story, attention to your balance sheet is essential.

The balance sheet provides a comprehensive list of your business’s assets, liabilities, and equity, and it’s simpler to understand than it seems, essentially boiling down to a basic equation.

Here’s a straightforward way to read your balance sheet in one sentence:

Your funding must equal your operations.

Funding (Debt +Equity) = Operations (Working Capital + Other Capital)

This is an equation of balance, which must always be in equilibrium.

Your Management Team Bears Responsibility for Working Capital and Profit

On that balance sheet, your management team has responsibility for three key elements:

- Accounts Receivable – The speed at which you receive payments from customers.

- Inventory – Or your ongoing Work in Progress.

- Accounts Payable – The rate at which you settle payments with your suppliers.

These three components constitute your Working Capital.

At regular intervals – monthly, quarterly, or as suits your business – your management team needs to monitor these items and ponder over these questions:

- How can we enhance our collection efficiency?

- Is it possible to guide our customers on prompt payment methods?

- Can we bill some work in advance?

- Are there strategies to minimize our inventory?

- Could we renegotiate terms with our suppliers?

Additionally, your management team holds accountability for the company’s Profit.

Hence, the senior team bears responsibility for the initial 2 Stages of the Cash Flow Oxygen Narrative framework (Stage 1: Profit and Stage 2: Working Capital).

What is the Cash Flow Oxygen Narrative?

Drive better cash flow and Cash Flow Oxygen Narrative provides a straightforward structure for comprehending the movement of money within your organization. This clarity is crucial for assessing the health of your cash flow and identifying areas for enhancement.

Stage 1: Profit

Stage 2: Working Capital

Stage 3: Other Capital

Stage 4: Cash Flow (or Funding)

Full transparency is essential regarding your financial figures.

Such openness is necessary as it significantly eases the accountability process for your CEO.

Drive better cash flow, the CEO bears responsibility for the business's outcome.

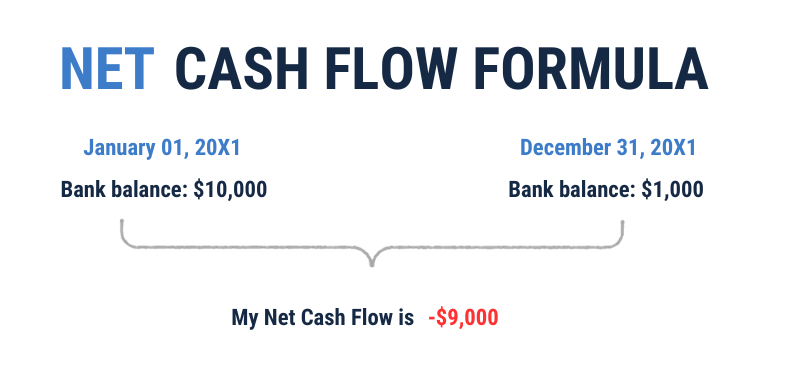

The net cash flow, representing the change in all your bank accounts, is the ultimate result of your business. This, essentially the movement of cash, constitutes the fourth and final Stage of the Cash Flow Oxygen framework.

The CEO holds accountability for this figure.

An important trait of a brilliant leader is to “always listen with empathy and always put yourself in other people’s shoes.”

Remembering this is crucial for aspiring to be a more effective CEO and accelerating your business’s growth in terms of cash flow.

Even if finance isn’t your strong suit, you can still become the L.E.A.D.E.R who understands the intricacies of the business game.

L – Listen (Observe that ‘listen’ shares the same letters as ‘silent’. Effective leaders speak last in

discussions.)

E – Empathy, guiding and listening with understanding

A – Always, consistently leading with positivity

D – Decision-making, adept at tough choices

E – Energize, capable of invigorating your team

R – Resilience (Success lies not in how far you fall, but in how swiftly you, as a leader, can rally the

company.)

Actively listen to your management team with empathy, demonstrating that cash is the outcome of effective growth and management strategies.

Afterwards, collaborate with the team in a workshop setting to explore potential changes that could benefit your company and improve its cash flow.

To succeed, you must adapt - and then persistently repeat the process

Keep in mind: This is a game focused on maximizing your profit, cash flow, and overall value.

Your management team holds accountability for the initial two Stages of your Cash Flow Oxygen (Stage 1: Profit and Stage 2: Working Capital).

The CEO bears responsibility for the fourth and conclusive Stage of your Cash Flow Oxygen (Stage 4: Net Cash Flow, the culmination of the first three stages).

Maintaining a consistent schedule of quarterly or monthly meetings with your team is essential for identifying opportunities to enhance your cash flow.

Utilize the Strength of One tool, to facilitate these discussions and streamline the decision-making process for financial improvements.

(You can access the Strength of One Tool here.)

Cultivate this practice within your team, continuously sharing your financial narrative, to gain a deep understanding of how to effectively scale up your company.

Direct Your Attention Towards What You and Your Team Have Control Over

Never before has cash flow been more important for your business.

To remain in control and ready for any potential business disruptions, you must transform into a proficient financial narrator.

What narrative does your cash flow reveal about your business, and what is its quality?

Once you can narrate this story, you can educate your team about the decisions that genuinely influence your company’s worth and instill a habit of making those decisions.

This is how you develop an appreciation for the numbers that steer business expansion.

Achieve Your Business Goals with Our Help

Small business owners have a lot on their plate. From managing day-to-day operations to finding new customers, it can be overwhelming. But one of the biggest challenges facing most small business owners is not having clear goals.

Without clear and well thought out goals for the things that matter most, like KPIs that drive revenue, profit, and cashflow, how can a business owner know if they’re making progress daily, weekly, or monthly?

It’s like getting in the car and driving without a clear destination. You’ll waste a lot of gas and a lot of time. However, this is typical of most business owners – they’re ‘driving’ without knowing exactly where they want to end up.

That’s where we come in. At SecureCFO , we can help you set clear and achievable goals for your business. We’ll work with you to identify the KPIs that matter most and create a roadmap to help you get there.

With our help, you’ll be able to track your progress and make informed decisions to ensure that your business is moving in the right direction. No more aimless driving – you’ll know exactly where you’re headed and how to get there.

As a certified CFO, I bring a robust blend of expertise and accreditation to the table, ensuring that my strategic financial management not only aligns with industry best practices but also drives substantial value and innovation in the services sector. My certification is a testament to my commitment to excellence and my capability to navigate complex financial landscapes effectively, making me a trusted advisor in your journey towards greater profitability and business success.

Don’t let the lack of clear goals hold your business back. Contact us today to schedule a consultation and take the first step towards achieving your business goals.

Achieve Your Business Goals with Our Help. Contact SecureCFO Today!